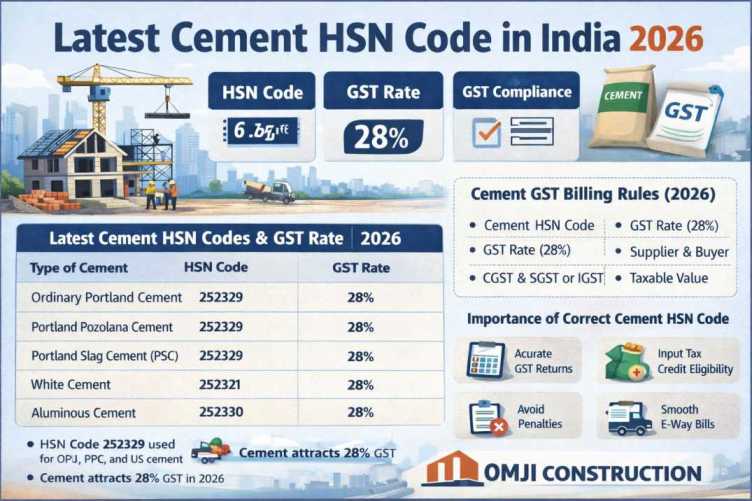

Understanding the latest cement HSN code in India (2026) is essential for builders, contractors, suppliers, and construction companies. Cement is one of the most heavily regulated construction materials under GST, and using the correct HSN code ensures proper tax compliance, accurate invoicing, and smooth GST filings.

In this article, we explain the updated cement HSN codes applicable in India for 2026, along with GST rates, cement types, billing rules, and compliance tips for the construction industry.

What Is an HSN Code?

HSN (Harmonized System of Nomenclature) is an internationally standardized system used to classify goods. In India, HSN codes are mandatory under GST for identifying products, determining tax rates, and ensuring uniformity in taxation.

Cement manufacturers, wholesalers, and construction companies must mention the correct HSN code on invoices, e-way bills, and GST returns.

Latest Cement HSN Code in India (2026)

As per the GST structure applicable in 2026, cement falls under Chapter 25 of the HSN system. The standard and most widely used HSN code for cement remains unchanged.

| Type of Cement | HSN Code | GST Rate |

|---|---|---|

| Ordinary Portland Cement (OPC) | 252329 | 28% |

| Portland Pozzolana Cement (PPC) | 252329 | 28% |

| Portland Slag Cement (PSC) | 252329 | 28% |

| White Cement | 252321 | 28% |

| Aluminous Cement | 252330 | 28% |

👉 Important: There is no reduction in GST rate on cement in 2026. Cement continues to attract one of the highest GST slabs at 28%.

HSN Code 252329 – Most Common Cement Code

The HSN code 252329 is the most commonly used cement HSN code in India. It applies to:

- Ordinary Portland Cement (OPC)

- Portland Pozzolana Cement (PPC)

- Portland Slag Cement (PSC)

Whether you are buying cement for residential construction, commercial buildings, or infrastructure projects, this HSN code is used in most billing scenarios.

GST Rate on Cement in 2026

The GST rate on cement in India for 2026 remains at 28%, plus applicable cess (if any). This has been a major concern for the construction sector due to the high tax burden.

Despite industry demands for reduction, the government has not revised cement GST rates as of 2026. Contractors must factor this cost into project budgeting.

Why Correct Cement HSN Code Is Important

Using the correct cement HSN code is critical for several reasons:

- Accurate GST calculation

- Valid input tax credit (ITC)

- Avoidance of GST penalties

- Smooth e-way bill generation

- Compliance during audits

Incorrect HSN codes can lead to mismatches in GST returns and notices from tax authorities.

HSN Code Requirement Based on Turnover

As per GST rules applicable in 2026:

- Businesses with turnover up to ₹5 crore must use 4-digit HSN codes

- Businesses with turnover above ₹5 crore must use 6-digit HSN codes

Large cement suppliers and construction companies are required to mention full 6-digit HSN codes on invoices.

Cement Billing & Invoicing Rules

When billing cement under GST, the following details must be included:

- Cement HSN code

- GST rate (28%)

- Taxable value

- CGST & SGST or IGST

- Supplier and buyer GSTIN

Proper invoicing ensures eligibility for input tax credit, especially for builders and developers.

Impact of Cement GST on Construction Cost

Cement contributes nearly 12–15% of the total construction cost. Due to the high GST rate, cement significantly impacts overall project budgets.

Construction companies must plan procurement efficiently and avoid billing errors to reduce financial losses.

Common Mistakes to Avoid

- Using outdated HSN codes

- Mismatching cement type and HSN code

- Incorrect GST rate application

- Missing HSN code on invoice

Regular GST compliance checks help avoid penalties and legal complications.

Why Builders Trust OMJI Construction

OMJI Construction follows strict GST compliance and transparent billing practices. We ensure correct material classification, accurate taxation, and cost-effective procurement for every project.

📞 Contact OMJI Construction for professional construction services and cost-optimized project planning across India.